In February 7, 2019, Pres. Duterte signed the law mandating all OFWs to pay for their contribution before leaving the country or their OECs (Overseas Employment Certificates) shall not be released. OFWs in different parts of the world (including myself) oppose this new law. OFWs are asking the Supreme Court to nullify the law for so many reasons. It used to be voluntary. It is still an on-going battle.

What most of us are contesting isn't really having the SSS in itself (I am still paying for my contributions until now) which offers a lot of benefits for those who would like to retire in the country--- but we are opposing the way it is imposed, implemented, and the system overall is not just 'oppressive' for those who are leaving and are already out of the country, but nothing, if not very little, is being done to make the procedures easier for us to ABIDE by the 'law'.

What do I mean by that? I only speak of my own experience, working overseas for more than a decade.

Many Filipinos who are living overseas and working legally in different countries are also provided or required by their companies / employers - social security contributions because it is also a part of the foreign government's employment policy for all the workers in their country. It means, most of us are 'insured' wherever we legally work. Not everyone who is leaving the country has enough money to pay for both at the same time. But guess what? Most OFWs I know would still opt to continue paying for their SSS contributions and would not 'run away' from their loans but they just need time to figure out their finances first (savings, padala sa pamilya and more). I for one have been paying (star award goes to my MOM!) for it since I started working in 2001. I skipped payment for a few months...for 2 main reasons:

1. Funding it wasn't really possible, I have financial emergency going on. Either I was in between jobs or just mostly busy focusing on working.

2. NO ABSOLUTE means to pay for it while you are overseas - unless you rely on your family member to do it for you. My mother has been religiously going to SSS bayad centers every month for years (and it's not near our home) just to pay for my contributions! Love you mom! BUT not everyone has a wonder mother like mine. Also, she turned 60 last year, reaping the benefits of her own SSS. She turned 61 this year, happily 'senior'. I want her and my dad who is 70 this year to enjoy their retirement years and hence, I've been finding ways how to do it by myself.

HOW DO WE PAY FOR OUR SSS Contribution while overseas?

I recommend to do this using a laptop or desktop computer because you will be opening your website, the email, and a couple of guides. It's just more convenient. I also suggest reading everything first and not do as you skim through.

I also suggest reading this very helpful complete guide about SSS at Grit.ph first if you want to know more about opening an SSS account online and benefits. EASY WAY: To pay for your SSS online, you need to have a UnionBank account, or you can pay online using Bancnet's online platform IF your bank in the Philippines is one of the following:

Consider yourself VERY lucky if your bank is listed above but if not, check in your bank's online banking options if SSS is in their biller's list. If it is, then you are saved! If not ---it's going to be a lot of hassle. BUT that's why I'm posting this, so my days of researching and grouchiness in the process would turn positive and help others. So read on. :) My bank is Banco De Oro (BDO), a 'partner' of BancNet in equities but not included in the list. I learned that having a BancNet logo at the back of my BDO Visa card doesn't necessarily mean anything or wasn't helpful in that matter. IF I had only known...

SO WHAT DO WE DO NOW?

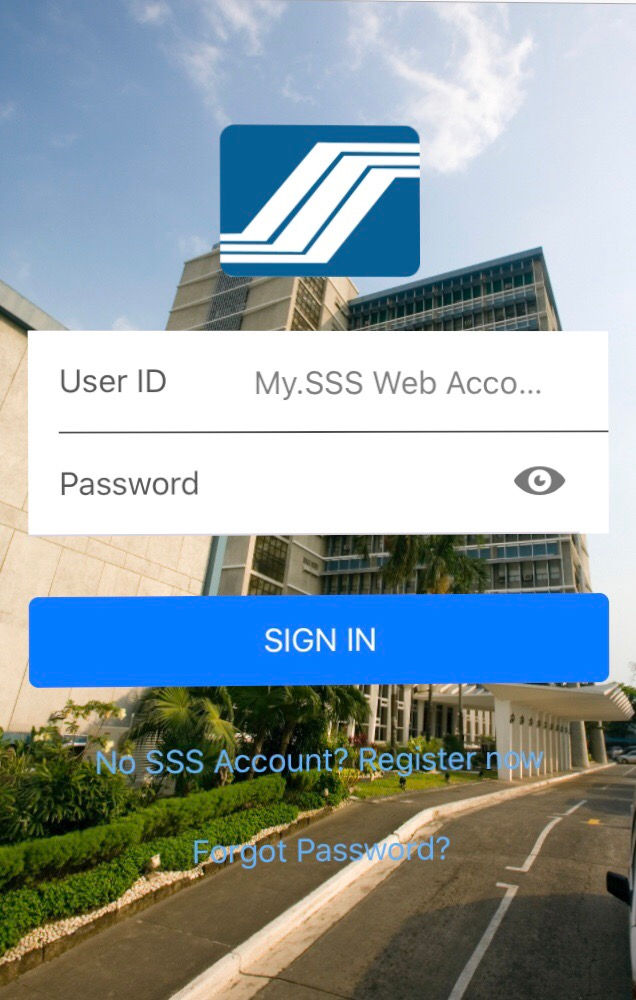

1. Enroll for an online SSS account. Click here. You need to provide all the information as mentioned in the complete guide link. Please read it because I will not cover the steps here.

You need to do this for 3 things: -To have all the access to your past documents -To keep track of your contributions and check if your payments went through -To get the PRN (Payment Reference Number) that is unique and changes every month. It is like an invoice number that you need to print/give the number to the SSS cashier or put in online forms as reference when paying your SSS so that the system could track and record it faster. Every month, before you pay, you have to generate a PRN from the website or the app as the reference for that specific contribution. They also have an SSS app for iOS and Android. You can use the app if you want to change your user information like phone number, email, local and foreign addresses, or use the 'mySSS BETA' link at the bottom of the SSS sign-up button at the website. The app is more user-friendly and convenient in generating PRNs, but the website offers more data and records that you cannot find in the app.

Once you have an access to your records and can get the PRN, you need to find an online service that is legit and has the service to pay for SSS/other bills.

2. Here are the 2 websites that I found:

Basically, these sites would ask you to open an account, fund your account, then use that fund to pay for your SSS or other services that they are offering for a fee. Disclaimer: I am neither affiliated nor recommending these sites. I am merely giving options to what may work for you and sharing what worked for me. Do your homework, research their profile and reviews, sign-up at your own risk. Also their procedures, Terms and Conditions and website/app format may change anytime so be careful. I am not responsible for any of your actions/decisions. If you have an issue with any of the companies mentioned, please seek for their customer support. Make an informed choice.

A company based in Singapore. You can pay your SSS and other government bills here by opening an account with them and funding it through: A. Online Banking -BPI Express Online - you need to apply for PayPilipinas to be added in your 'biller's list' at your BPI Branch (so if you're already outside the country, this won't help!) -MetroBank Direct -PNB Personal Internet -RCBC Access One -Chinabank Online B. Visa/MasterCard Credit Card C. Over the Counter - with some bank choices in these countries - Australia, Austria, Bahrain, Belgium, Brunei, Canada, Hong Kong, Israel, Italy, Japan, Korea, KSA, Kuwait, Macau, Malaysia, Netherlands, Palau, Saipan, Spain, Taiwan, UAE, UK, USA

Sadly, Thailand is not in the list, and again, BDO. I was hoping to use the Visa/MasterCard but the 4% surcharge is huge on top of their sending/processing fee and it's not going to do me any good if I intend to use it monthly in the long run. The payment is also in USD and they have their own USD-PHP rate. I have read reviews though, that if you fund it via online banking, the rates are better. Reviews also say that it takes about 3-4 working days for you to see the fund transferred to your PayPilipinas account. There are a lot of positive reviews about it, but why I didn't choose this is because when I read the Terms and Conditions (yes! I read those things that are long and written in the smallest font size stuff!), it always refers to 'Singapore user' and I wonder if those who have signed up from other countries could get legal support just in case there is a dispute. Also, I have searched everywhere but there seems to be no way to 'cash out' your remaining balance from the fund unless you are good in calculating how much USD you'd put in your account to the last cent. There are provisions written in the T&C, but I guess you have to write in and request for it and of course, it may come with processing fee.

If you decide to use this, here's a comprehensive blog post from WorkingPinoy.com on how to pay your SSS contribution via PayPilipinas.

- Coins.ph

This one is mainly a platform for buying, trading bitcoin and other digital currencies. BUT they also have loading facilities as well as government billing payment services. You can fund your Wallet there - also called "Cash In" by multiple methods: -Palawan Pawnshop -MLhullier -7-Eleven (Philippine stores only) -7-Eleven CLIQQ (Philippines only) -LBC Bills Xpress via DragonPay -PeraHub -Tambunting -Bayadcenter -Globe GCash - but GCash can pay directly to SSS as well so if you have it, you don't need to be signing up for this unless you want to invest in BitCoin as well. Click here to know how. Not OFWs have GCash or Globe SIM with them abroad so this isn't my choice. -UnionBank* -WesternUnion* -Online Banking*: EastWest Bank, ING Bank N.V., Metropolitan Bank and Trust Company, Philippine National Bank, Philippine Savings Bank, -Over-the-Counter: BPI / UnionBank / Chinabank via DragonPay/SM Department Store and Robinson's.

As you can see, BDO is NOT in the list as well. THEY USED to be in that list, but I wondered why they were removed. Also, only the ones I wrote in bold and with asterisks are helpful for OFWs who would want to pay their SSS online.

Reading the reviews, the site is a legit website. They also have an app for iOS and Android users. I have written to their customer support and they so far have replied timely and on point. There were however a lot of negative reviews about the usability of the platform when it comes to Bitcoin and Digital Currency trading. There are always high risks in trading but I mainly signed up for their bills and SSS payment service and the reviews in this area are mostly positive. Because of the trading part, the signing up needs different level of verification for security and as mandated by law. So have your passport/any government card ready. It will ask you to fill-up standard forms online and take a 'selfie'. Yes. Selfie of you holding your valid government issued ID. Then the next one would be uploading a picture of that government issued ID in their system. They will also send a verification code / link in your email to make sure it belongs to you. The whole process takes about 15 minutes if your ID is ready and you are signing up using your laptop with camera (as in my case) or your mobile phone.

Once you verified your email, you can access your Coins.ph account already BUT your wallet will not be opened for access until your submitted documents have been authenticated and approved by them. You will receive an email the next day or in the next 12 hours.

Without having a lot of choice as of now, I would go for this platform and use their Western Union option for FUNDING my Wallet. 1. Send money to Western Union the usual way, with the receiver as myself. You have to use your real name in signing up for account at Coins.ph this name has to match the name you would send the money to through Western Union. Send the money in PHP rate so you get the exact amount in your wallet.

2. Log-in to your Coins account and click 'Cash In' and click Western Union. 3. Type in the MTCN (Western Union Tracking number) and the estimated amount if sent in other rates or the PHP equivalent. 4. Tap 'Next' and you will receive the funds in your Wallet almost instantly.

PAYING your SSS via Coins.ph:

1. Go to your SSS app and generate PRN code for the contribution you will be paying for. Note this down because you will need it for payment. 2. Go to your Coins.ph account and click PAY BILLS.

3. Go to the SSS CATEGORY and choose the TYPE of SSS Payment (loan, Flexi-fund, etc)

4. Enter your PRN, Amount Due and Click *PAY!

*Make sure you have enough money in your Wallet to pay for the bill *Check in your SSS app the successful payment.

What's good about it is that there is a "CASH OUT" feature where you can withdraw your funds anytime. They also offer rebates for first time or unique payments.

TOP TIPS:

If you are an OFW/expat and you are coming home for a visit and intend to continue paying for your bills overseas by yourself without relying on your family members/other people:

1. Know the available and most financially beneficial means of sending money from your country to your Philippine account so you can fund your PH Savings. Find the HIGHEST RATE with the LOWEST FEES. Here in Thailand, local government banks such as GSB (Government Savings Bank) and SCB have RIA service that can send directly and instantly to BDO / BPI account. Their currency rates are often higher than Western Union.

2. Know what bills you want to pay in the Philippines and their e-Payment affiliates. OPEN an account to any of those listed in BancNetonline that gives you low/no maintenance/high interest rates THAT ALSO you can fund directly when you're overseas OR one that you can also access online and fund from your other bank (example: transfer thru online banking from my BDO to UnionBank account)

3. You can also opt to apply for SSS ADA (Automated Debit Arrangement) Program if your current bank is in their affiliated list. It is giving authority to SSS and your bank to debit a certain amount in your bank account for your loan/contribution payment. You need to fill-out forms and personally submit it. See here.

4. If you have the luxury of time, APPLY for UMID (Unified Multi-purpose ID) or upgrade your SSS ID to UMID. One of the most powerful government ID cards you can use for SSS, Pag-Ibig, GSIS needs and also honored as valid identification in other countries. Best of all --IT IS FOREVER! No expiration date. Here's a definitive guide from FilipiKnow on how to get one and activate it. DO NOT forget to ACTIVATE it so you can use it as an ATM as well when you get your SSS salary loan, they will deposit it there / your future pension. This is in my 'to-do' list.

If you cannot collect it, already prepare the documents to authorize someone to pick it up for you and have it activated the next time you're back in the country.

5. Update / organize your 'financial-related accounts' - your SSS, private insurances, get your TIN (if you plan in doing stocks trading/investments) and while there, if you can already apply for investments accounts that need your personal appearance or need to be linked to your bank/paid regularly - do so. So that upon leaving the country, you are more at peace and more inspired to work on your personal and financial goals.

Reflections / Thoughts:

So now you can see-- how much of a hassle it is to pay for SSS voluntarily while overseas. The government requires so much, but does so very little to make it easy for people to follow through.

For sure, our contributions are also for 'us' later on, but:

1. Why not have more e-Payment options for SSS? Why only BancNet partners and UnionBank?

2. Why not MANDATE all the BANKS in the PHILIPPINES to ADD ALL THE GOVERNMENT SERVICES in their BILLER's LIST? and leave the option on when to send whenever we can send to us. Because, believe it or not, WE LOVE our country. Most of us are here because we actually want to give back to our families, to our country. BUT if we will ALWAYS have to be the one to 'find ways' (looking at you too, BDO!) to do what is 'required' even in problems as small as this--SOBRA NA PO.

3. Why the largest and most trusted banks in the Philippines can't help us push for the inclusion of these in your online banking? May masasagasaan po ba?

It's probably NOT EASY at their end to make these changes for the OFWs...after all, sana'y naman na tayo na nagtitiis...but if they really do care for the 'bagong bayani', sana kahit sa maliit na bagay tulad nito, may konting pagtulong po.

So many whys...and that's just one little example - PAYING SSS. And I'm sure some people may say "PHILIPPINES HAVE MORE BIGGER PROBLEMS THAN THAT!" I say - 'yun na nga e, maliliit na butas, lumalaki...combine them all together - it's a disaster.

Bangon, Pilipinas! Mabuhay ang OFWs and Expats! Hope this helps.

x, AJ

Comments